Summary

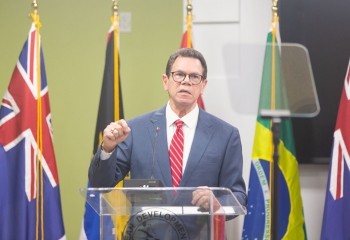

- 18th Annual Caribbean Energy Conference Panel Discussion: Financing for Small Countries S. Brian Samuel Head of Public-Private Partnerships (PPPs) Caribbean Development Bank January 25–26, 2018, Grand Hyatt, Baha Mar, Nassau, Bahamas

- AGENDA • Challenges of PPPs in the Caribbean • Jamaica’s renewable energy auctions: A replicable model for utility-scale RE • Public/Private Partnerships: What is CDB doing? – Regional Support Mechanism (RSM) – PPP Helpdesk – PPP Toolkit • CDB financing for RE/EE projects: – Sustainable Energy for the Eastern Caribbean (SEEC) – Climate Action Line of Credit (CALC) – CDB GeoSmart Initiative – Canadian Support to Energy Sector in the Caribbean

- “The Seven Deadly Sins of PPPs” 1. Lack of technical capacity: key barrier to PPPs in the Caribbean 2. Mistakes in risk allocation invariably fall into the government’s lap 3. Too many BMCs enter into PPPs without sound technical/legal/financial advice 4. Small size: Most islands are below the radar screen of global investors 5. PPPs quickly become political hot potatoes 6. Too many unsolicited proposals 7. Lack of funding for project preparation

- In PPPs, Jamaica leads the way • Starting with Montego Bay Airport in 2003, Jamaica has implemented several large, transformative PPPs (ports, highways, RE) • Mature PPP Policy and capacity in PPPU • As a result, Jamaica leads in private infrastructure investments:

- Jamaica’s RE auctions led to boom in capacity • CDB case study* on Jamaica’s RE Auctions • A model for utility-scale private RE projects • Jamaica’s RE at 16%, highest in Caribbean • RE drive started by GOJ/PCJ, to prove the theory • After which, the private sector piled in: * http://www.caribank.org/uploads/2014/05/Booklet-Public-Private-Partnerships-in-the-Caribbean-Building-on-Early-Lessons.pdf Project Megawatts Investors Wigton I (wind) 20.7 Petrojam / GoJ Wigton II (wind) 18.0 Petrojam / GoJ Wigton III (wind) 24.0 Petrojam / GoJ BMR Wind 36.3 BMR Energy / Branson Content Solar 20.0 WRB Enterprises Eight Rivers Solar 33.1 Rekamniar Ventures / Neoen Total Renewable Energy 152.1 = 16% of installed capacity

- Lessons of experience from Jamaica’s RE auctions • Government leadership is key: Requires political will, technical capacity and financial commitment • Competition is paramount: More bidders result in better bids. Period. • Multiple rounds: With each new auction, Jamaica’s Office of Utility Regulation (OUR) learned from experience, and got better at it • Size matters: Bigger projects attract bigger, more qualified investors • Pre-negotiate the PPA: Include details on voltage, frequency and transmission • Involve the offtaker: Make sure the utility participates fully in the bidding process • Clear criteria: Evaluation criteria for winning bids must be clear and transparent

- CDB support to PPPs • Regional Support Mechanism (RSM): – PPP Helpdesk: Technical Assistance (TA) interventions, in project development, Policy and capacity building – PPP Boot Camps: Trained senior public sector employees, in PPP theory & practice – Caribbean PPP Toolkit*: Open knowledge resource on PPPs, tailored to Regional environment and market conditions – PPP Policy: Assisting governments implement PPP policies and procedures that promote transparency and competition * https://issuu.com/caribank/docs/ppp_toolkit-interactive?e=21431045/49237432

- CDB’s financing for RE/EE projects • Sustainable Energy for the Eastern Caribbean (SEEC): – US$21 million Pilot program for funding EE/RE projects in government buildings in EC – Public sector including EE/RE in government buildings and EE in street lighting through retrofit with LED lamps. – Blended financing: grant (EU-CIF; DFID) and loan from CDB • Climate Action Line of Credit (CALC): – EIB funding to CDB for Climate resilience, RE/EE, with interest rate subsidy, available to public and private sector projects • GeoSmart Initiative: – CDB’s umbrella support to Geological Energy (GE) – TA, Investments, grants, CRG, & concessional loans for GE in EC. Needed due to risk profile of GE Projects, constraints on Governments – Resources: (1) SEF/IDB loan; CTF-CRG; GEF grant: $42.9M; (2) SEF/GCF funds approved thru IDB: Loan, CRG, grant: US$80M; (3) EU-CIF, TA and investment grant: €12M

- CDB’s financing for RE/EE projects • Sustainable Energy Facility (SEF): – CDB/IDB Program for TA and Investments in RE/EE projects – mainly for Geothrmal energy, hence falls under GeoSmart (items 1, & 2) – Total resources approved/mobilized: US$122M funding thru IDB – IDB/OC, GEF & CTF, GCF • Canadian Support to the Energy Sector in the Caribbean (CSES-C): – CAD$5M TA fund for regulatory strengthening, capacity building and project development • Renewable Energy and Energy Efficiency Technical Assistance (REETA): – €3 million GIZ funding for Technical Assistance in addressing regulatory and market issues in RE/EE sector – Technical support for financial institutions, including CDB

- Focus on Geothermal • CDB’s GeoSmart Initiative: A basket of TA and funding mechanisms for geothermal development in the EC • CDB financed St. Vincent Geothermal with $9.5M Contingently Recoverable Grant (CRG), plus mobilizing DFID & other Grant resources • Current risk-cost profile of geothermal projects in the Eastern Caribbean:

- CDB’s Renewable Energy & Energy Efficiency Unit (REEEU) CDB established REEEU in 2014, to implement key goal of Strategic Plan: 1. Business Development & Technical Support: – Identification/screening/pre-feasibility of RE projects, then handed over to Projects Department, appraisal/due diligence and implementation supervision – TA for project preparation, Capacity Building 2. Manage Facilities and Programs: – E.g. SEEC; GeoSmart; CSES-C 3. Mobilize Resources for Renewable Energy: – Climate financing – Other concessional resources (e.g. EU-CIF) 4. Mainstream RE and EE within CDB: – Ensure that all projects being pursued by CDB consider RE/EE where relevant

- TITLE AND CONTENT WITH PICTURE CDB contacts: Renewable Energy / Energy Efficiency Unit (REEEU) Direct: (246) 431-1721 reee@caribank.org S. Brian Samuel Head of Regional PPPs Direct: (246) 431-1681 Cell: (246) 230-6408 samuels@caribank.org