Finance in Common 2021 Summit - Leaders' Dialogue

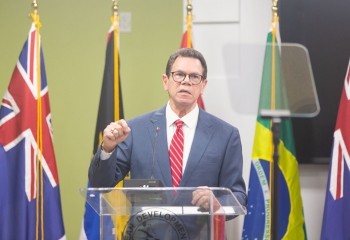

Thanks for the opportunity to speak on behalf of the Caribbean Development Bank (CDB) at this important Finance in Common Summit Leaders’ Dialogue.

I want to highlight the broad challenges that Caribbean countries are currently facing and raise three important issues.

CONTEXT

The Caribbean is in the midst of a perfect storm created by the collision of the Region’s past and persistent structural weaknesses; the present impact of the COVID-19 pandemic; and expected losses that characterise the Region’s vulnerability to natural hazard events. The impact of the COVID-19 pandemic has been profound. Our Borrowing Member Countries (BMCs) have been set back in their development process and the pursuit of the Sustainable Development Goals (SDGs). Thirteen of our BMCs recorded double-digit declines; poverty has increased; the digital divide has excluded some children from access to education with long-term implications for human capital accumulation, productivity and innovation; gender equality has been set back; and inequality has worsened.

IMPORTANT AREAS FOR DIALOGUE

How can Multilateral Development Banks (MDBs) help? We believe through active collaboration and partnership in the pooling of resources.

(a) First, MDBs have a critical role to play in driving reforms to help member countries grow and achieve their sustainable development targets. To do this effectively, we need a holistic development framework that takes cognisance of the interplay between the debt sustainability framework of the International Monetary Fund (IMF), the investment-growth framework of the World Bank, and the resilience-building framework of the United Nations. Multilateral development banks need to review their scope of operations and activities to foster consistency with this wider framework, while ensuring their operations are tailored to the needs and specific circumstances of member countries.

(b) Second, Small Island Developing States (SIDS) have their own peculiar vulnerabilities and characteristics that need focussed attention. SIDs have a particular need to integrate vulnerability and resilience into their development frameworks. We have long recognised the need for a vulnerability index in the Caribbean; and CDB is upgrading its framework to incorporate multi-dimensional aspects of vulnerability and resilience that better reflect the economic, social, and environmental realities of the region. Our revised vulnerability and resilience framework considers pre-event metrics (probabilistic nature of susceptibility to shocks - natural hazards/external), the magnitude of the event when it occurs (a welfare-loss measure that depends on the severity and intensity of the event, as well as the initial economic and social conditions current at the occurrence of the event), and internal resilience capacity or the duration it takes to return to the pre-event state. Each of these states requires distinct policies, conditionalities, and modalities of financing.

(c) Third, a holistic development framework necessitates that we also approach financing needs in a holistic manner, addressing both the existing debt stock problem and flow financing for development. We are proposing a financing framework for sustainable development that focuses on financing for rescue, recovery, and repositioning - what we, at CDB, term the 3Rs of sustainable development financing.

- Rescue highlights flexibility and the immediacy of meeting liquidity needs arising from emergencies. Here, the issue is quantum available, conditionalities, and speed of disbursement. o Recovery provides liquidity needs for rebalancing but also includes financial resources geared to start the process of repositioning. This includes policy-based instruments that can be used to finance exogenous shocks and can be either loans or grants.

- Repositioning looks at the longer-term development goals, with a view to addressing persistent structural weaknesses and transforming our economic, social, institutional, and environmental structures to achieve wealth-creating, sustained, and inclusive development. Collaboration is particularly important here; and we see room for innovation and openness to new ideas — for example, more co-financing, cross-conditionality support, crowding-in of private sector financing, and more insurance-related and contingent-state instruments.

Let me end with two specific ideas on financing.

- (a) First, one approach to effectively crowd in the private sector is by structuring our financing in tranches so that the private sector, multilateral development banks, and governments could meet their financing needs at lower interest rates. But drawdowns would be contingent on implementing key reforms — thereby providing incentives to lower the implementation deficits we face. That would require a collaborative effort on the pricing of reforms.

- (b) Second, CDB has proposed to CARICOM Heads of Government that they should pool recent allocations of Special Drawing Rights (SDR) to better leverage these resources for building resilient economies. The proposal includes the issuing of marketable financial instruments—SDR-denominated Resilience Bonds (SRBs)— to our BMCs, in exchange for their recent SDR allocations. This pool, which could also be augmented by other CDB members and non-members, would be taken on board the balance sheet to be managed as counterpart assets underpinning the Bank’s general obligations and liabilities under the bonds. The bonds can be offered as investment-grade collateral used to secure fast-disbursing short-term and emergency loans; or to secure access to financial risk-management products for currency, interest rate, and commodities hedging; and to attract additional long-term development finance, as well as crowd in regional and international private capital into local financial markets within BMCs. The focus would be on advancing complex, high impact, but financeable development projects. This is another area where collaboration (expertise, experience, and common interest in development) could provide significant benefits.